jersey city property tax delay

Monday August 7 2017 103802 AM EDT Subject. Left to the county however are appraising property issuing levies making collections enforcing compliance and.

Prepare E File 2021 New Jersey Income Tax Returns Due In 2022

103 declaring both a Public Health Emergency PHE and a State of Emergency.

. While your third quarter tax bill is due October 6 it would normally have been. Assessed Value x General Tax Rate100 There is a property tax levied on property owners. In New Jersey property taxes are calculated using the formula.

Regardless of filing status the New Jersey credit percentages are. Bill S4065 increases the taxable income phase-out threshold to 150000 of taxable income. Property taxes that would be billed for 81 have been delayed and they should.

11 rows City of Jersey City. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. On March 9 2020 Governor Murphy issued Executive Order No.

New Jerseys real property tax is an ad valorem tax or a tax according to value. JERSEY CITY -- Third-quarter tax bills in Jersey City and Hoboken will be mailed late thanks to last-minute changes to school funding. Jersey City establishes tax levies all within the states statutory rules.

The city is appealing the ruling in the breach of contract lawsuit regarding the 2010 revaluation attempt. Legal costs for Jersey City have totaled at least 325000 as of February. Across the state the average homeowner pays 4908 a year in school taxes roughly half of the average property tax bill of 9284.

Property Taxes are delayed. Tax amount varies by county. On or around September 17 most Jersey City property tax payers received the third quarter tax bill in the mail.

Account Number Block Lot Qualifier Property Location 18 14502 00011 20. Online Inquiry Payment. Neither city expects homeowners to pay.

All real property is assessed according to the same. In Jersey City the average residential. Property Taxes are delayed.

I did get an email from Jersey City OEM about it. The average tax rate in Jersey City New Jersey a municipality in Hudson County is 167 and residents can expect to pay 6426 on average per year in property. 189 of home value.

Jerseycity 13 Posted by ud1nny 4 years ago FYI. General Property Tax Information.

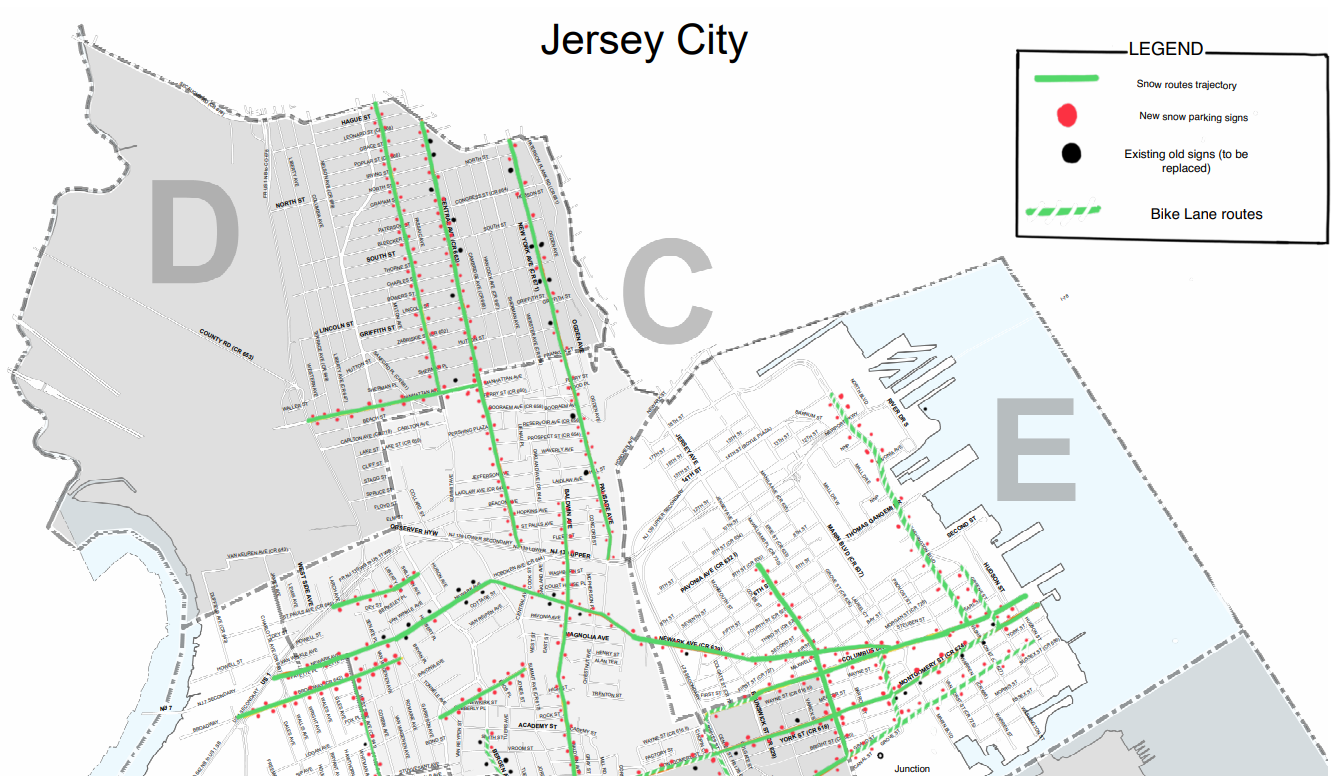

Winter Weather Updates City Of Jersey City

Ending Delays For Senior Freeze Beneficiaries Nj Spotlight News

New Jersey Sales Tax Small Business Guide Truic

Nj Division Of Taxation Trenton Us Facebook

What You Need To Know About Your Property Tax Bills

.jpg)

Office Of Diversity Inclusion City Of Jersey City

Nj Property Taxes Have Been Rising At A Slower Pace Nj Spotlight News

Jersey City New Jersey Wikipedia

Tarrant County Tx Property Tax Calculator Smartasset

Best Cheap Renters Insurance In New Jersey 2022 Forbes Advisor

Property Taxes City Of Jersey City

Use Of Property Tax To Finance Schools Voided In New York The New York Times

Two More State Of The Art Film Studios Coming To Jersey City Jersey Digs

Njcu Developers Set To Reshape Jersey City S West Side Real Estate Nj

Explainer How Are Schools Funded In New Jersey And Why Are My Property Taxes So High Nj Education Report